You’re Fired! You’re Fired! Overstated (“Fake?”) Jobs Data, and What it Means for Investors

[embedyt] https://www.youtube.com/watch?v=WobrMi5xENY[/embedyt] In the words of Pre-President Donald Trump, “You’re Fired”. And with the stroke of a pen, or maybe it was the delete key on an old Intel Inside PC from the year 2000 or 2007, your taxpayer funded Bureau of Labor Statistics, or BLS, or economic and markets tables, eliminated 818,000 jobs in…

Fast Money: Right Back Where we Started From

[embedyt] https://www.youtube.com/watch?v=t1obWGLTC_o[/embedyt] Investors let’s call last week what it really was, fast money. I remind viewers that these videos are scripted on a Sunday, filmed early Monday morning, edited and reviewed by compliance during the week, and released on Friday afternoon. A lot can happen in 5 days, both good and bad. If you were…

Yen There, Done That – August 2007

[embedyt] https://www.youtube.com/watch?v=8EW0toidgOs[/embedyt] Global stock markets sold off violently 2 weeks ago and the SP500 cash index opened Monday August 5th down another -3%+ to take the index down -9.7% peak to trough over the last 3 weeks. That’s of course if you were a perfect seller and buyer. The current thumping started on Friday…

Seasonality or More – Buy the Dip?

[embedyt] https://www.youtube.com/watch?v=oHrLikKpR-M[/embedyt] Global stock markets sold off violently last week, particularly on Friday. The technology-heavy Nasdaq 100 Index tumbled into a correction and the S&P 500 Index lost -3.2% in two days, its worst two-day stretch March 2023. Later cycle, or slower cycle, “Garp” stocks, “growth at a reasonable price, healthcare, utilities and real…

What Could Go Wrong? It’s Deja Vu all Over Again

[embedyt] https://www.youtube.com/watch?v=36LDWjbXFqw[/embedyt] As an investment professional with over 30 years’ experience in public markets, actually managing other people’s money, actually, as they would say in our business “pulling the trigger”, that is not writing theoretical or academic papers and studies on the markets, or publishing a $99/month newsletter service, I seem to rarely get asked…

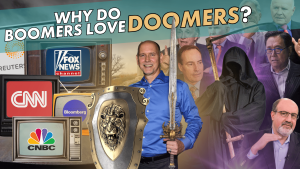

Why Boomers Love Doomers like Harry Dent, Robert Kiyosaki, and Robert Prechter

[embedyt] https://www.youtube.com/watch?v=2gBjCnj_jHQ[/embedyt] Harry Dent, demographic economist, and book and newsletter writer. Robert Kiyosaki, book writer, serial “entrepreneur, and seminar promoter. Robert Prechter, financial author and newsletter publisher. All have 4 things in common. 1. Successful self-promotion of their financial acumen, 2. Horrible long term track records of their predictive abilities, 3. To the best of…

Russell 2000 – Rotation Nation or just Squeeze me Seymour, more Little Shop of Horrors’?

On the morning of Thursday July 11th, the government released its much-anticipated monthly CPI inflation report. It was lighter than economists expected thus given hope to 1 – earlier Federal Reserve rate cuts and 2- more rate cuts in 2024 and 2025.Recall that in his last few speeches, Federal Reserve Chair Jerome Powell indicated…

Stock Market 1H24-“Everyones a winner?” Not

[embedyt] https://www.youtube.com/watch?v=SFs3TyvhKRg[/embedyt] The 1h24 is almost in the books and most strategists will be releasing their recaps and 2h24 outlooks. I’m going to jump the gun and recap the 1h a little early. Why? Because about a week ago, I penned an internal email to the advisor group here at OHFG, outlining what has transpired…

2024 Summer Stock Markets: Where Things Get “Real”ly “Interest”ing

[embedyt] https://www.youtube.com/watch?v=fYRpkzGGGKE[/embedyt] We are almost halfway through 2024, and I will admit, this has been one of the more interesting years I’ve seen during my career. While volatility at the S&P500 Index level remains near historically low bounds, ex 2007, single stock volatility is uch higher than I can recall. You have large cap tech…

Summer Loving – Tactical Trading

[embedyt] https://www.youtube.com/watch?v=1E6J_rHzX_E[/embedyt] Once or twice a year I find myself penning a script to a video, combating the almost constant dire economic and stock market bubble warnings from the likes of Harry Dent, Rober Kiyosaki, retired hedge fund billionaires, and for the last 15 years and counting, Jeremy Grantham. Most of these calls actually come…